SUCCESS TRANSFORMER CORP BHD

Profits shine through

By the looks of things, profits of Success Transformer Corp (STC) being clouded by its subsidiary has come to an end.

With promising 2Q15 results released yesterday, this low P/E stock of decent quality looks like it’s on its way for a rerating.

Based on yesterday’s closing price of RM1.38 and an annualized 2Q15 EPS of 40.64 sen, the stock is trading at a prospective P/E of just 3.4x. If we apply a P/E of 6x to that annualized EPS, it would give the stock a value of RM2.44, or an upside of 77% to its last traded price.

To recap, STC’s 65% owned subsidiary, Seremban Engineering Bhd (SEB) posted heavy losses in 4Q14 and 1Q15 due to cost overruns of the Sabah Ammonia Urea project (which is more than 90% complete now). This clouded STC’s transformer and lighting profits as they were consolidated with SEB’s (see Figures 1, 2 and 3, highlighted in red).

Based on SEB’s 2Q15 report, it appears like the cost overruns had mostly been provided for in 1Q15 and will no longer be seen in SEB’s future financials.

Figure 1: SEB quarterly P&L

Source: Company quarterly reports

Source: Company quarterly reports

Figure 2: STC quarterly P&L

Source: Company quarterly reports

Source: Company quarterly reports

Figure 3: STC quaterly segmental profit

Source: Company quarterly reports.

Note: Segmental profits here are approximations as the company does not provide profit breakdown by segment in quarterly reports.

a Derived by subtracting b from c

b Operating profit/loss taken from SEB’s income statement.

c Operating profit/loss taken from STC’s income statement.

Source: Company quarterly reports.

Note: Segmental profits here are approximations as the company does not provide profit breakdown by segment in quarterly reports.

a Derived by subtracting b from c

b Operating profit/loss taken from SEB’s income statement.

c Operating profit/loss taken from STC’s income statement.

The latest 2Q15 results show SEB’s profit levels to be back in the normal range (albeit at the lower range due to a drop in sales), and as a result, STC’s transformer and lighting segment's profits are now shining through again.

The transformer and lighting segment showed decent margin expansion vs. in most recent quarters; revenue grew about 3% yoy while operating profit climbed 13%.

For the process equipment segment, sales dipped 32% yoy, but this didn’t affect STC’s overall profits much. Even if we stripped out or assume zero profits for this segment, STC’s net profit would have still been around RM10.5m or 9 sen EPS in 2Q15.

I have read some articles on STC’s business outlook especially on its LED lighting and I’m quite convinced. Could 2Q15 be a precursor to STC’s continuation in growth?

Figure 4: STC’s segmental results, 2010-2014

Source: Company annual reports.

Source: Company annual reports.

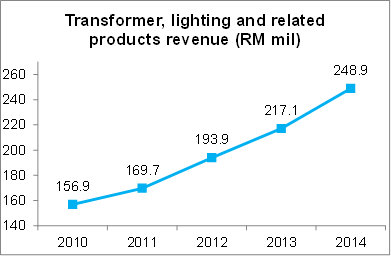

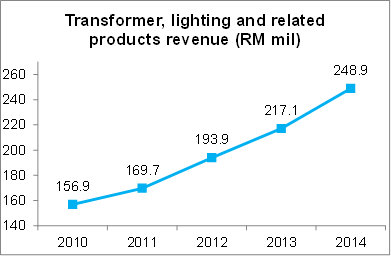

Figure 5: STC’s transformer, lighting and related products segment revenue, 2010-2014

Figure 6: STC’s process equipment segment revenue, 2010-2014

I'm not too concerned about Success' capex levels as the company is in expansion/growth mode. I believe Success is taking the opportunity to expand fast while they can. If they're spending to expand an unprofitable business then that would obviously be bad, but this isn't the case for Success.

I'm not too concerned about Success' capex levels as the company is in expansion/growth mode. I believe Success is taking the opportunity to expand fast while they can. If they're spending to expand an unprofitable business then that would obviously be bad, but this isn't the case for Success.

Once they've taken expansion to a good enough level, they would cut down on capex, and now with the higher profits levels from the expansion, the effect would be: strong cash flows, which would lead to debts going down and cash going up.

A good company from a long-term investor's point of view.

*********

“Currently we are actively exporting our lighting range to more than 40 countries, tapping the global market.”

– STC Annual Report 2014

MIECO CHIPBOARD BHD

Particleboard pioneer finally turning around?

In the fibreboard and particleboard space, Evergreen and Heveaboard may be names that come to mind as both companies are currently being promoted by at least one research house; both have also performed well along with Malaysian furniture companies.

But investors could now be starting to take a closer look at Mieco Chipboard after its 2Q15 results (see figure 1) was released last Friday, 21 Aug 2015.

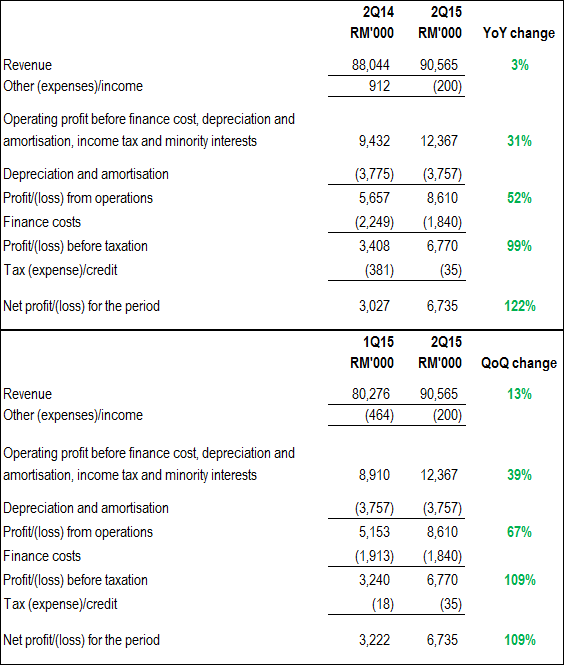

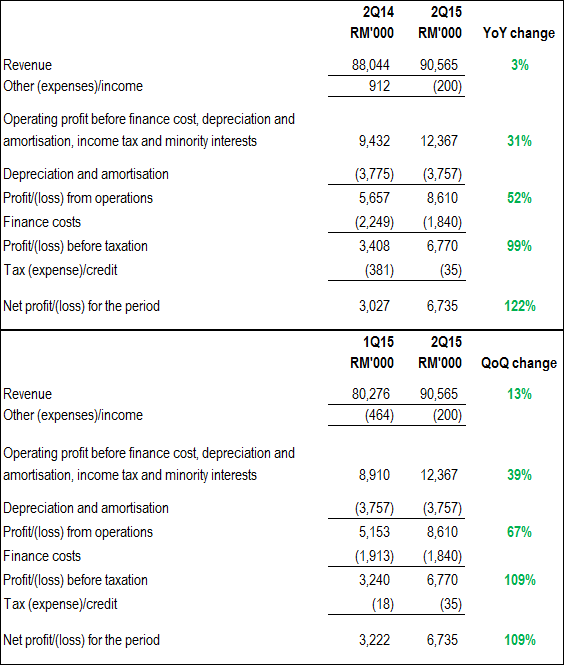

Figure 1: Mieco’s 2Q15 year-on-year and quarter-on-quarter results comparison Source: Mieco quaterly reports

Source: Mieco quaterly reports

Profit margin expansion was notable. Mieco attributed the improved performance to:

1. Better selling prices

2. More value added sales

3. Favourable raw material costs (particularly for glue and raw wood – two major raw materials)

4. Improved plant operations

These are in line with what Hevea and Evergreen have been saying, except Mieco didn’t mention it had directly benefited from the USD strengthening. It seems Mieco’s sales are more domestic oriented: “The Group targets to grow its domestic export-oriented market with the strengthening of the US dollar.”

Another factor for margins improving were declining finance costs, a positive trend I see continuing as Mieco deleverages (see figure 2).

Figure 2: Mieco’s debt levels, 2Q13-2Q15

Source: Mieco quarterly reports

Source: Mieco quarterly reports

But note that Mieco also has about RM50m (RM45.8m + RM4.1m) due to its immediate holding company.

Peer valuation comparison

Figure 3: Evergreen snapshot

Source: CIMB estimates/forecast, company annual & quarterly reports

Source: CIMB estimates/forecast, company annual & quarterly reports

Figure 4: Heveaboard snapshot

Source: CIMB estimates/forecast, company annual & quarterly reports

Source: CIMB estimates/forecast, company annual & quarterly reports

Figure 5: Mieco snapshot

Source: Company annual & quarterly reports

Source: Company annual & quarterly reports

Based on CIMB’s estimates/forecast (which are used in the figures above) and last Friday’s closing prices, Evergreen is trading at a forward FY16 P/E of 8.2x, while Hevea at 8.1x (fully diluted basis).

For Mieco, I couldn’t find any profit guidance from management in news or company reports, so there are no clues as to what FY16 net profit could arrive at. We don’t know what the plant utilisation rates are and how many shifts the lines are on, the order trend, if it will now emphasize on export sales, product mix, etc.

But let’s just make a simple earnings assumption to see what upside potential the stock has.

If we annualize Mieco’s 2Q15 net profit of RM6.735m, we get RM26.94m or EPS of 12.83 sen. Based on last Friday’s closing price of RM0.835, this would value Mieco’s stock at a P/E of 6.5x, which is below the 8.1-8.2x forward P/E Evergreen and Hevea is currently trading at.

If Mieco gets rerated to Evergreen's and Hevea's current forward P/E of about 8x, then Mieco could trade at RM1.03, an upside of 23%.

From a P/BV standpoint, Evergreen and Hevea are both trading above 1x P/BV, whereas Mieco is trading at 0.62x P/BV (based on its book value per share of RM1.35 as at end-Jun 15).

Is Mieco’s 2Q15 earnings level sustainable? Evergreen’s and Hevea’s earnings are projected to grow by 43% and 18% respectively from FY15-16, so I believe given the overall pickup in demand in the sector, it is not unreasonable to assume that Mieco can sustain its 2Q15 earnings levels.

Some might have noticed that Mieco’s effective tax rate is lower than the statutory income tax rate of 25%.

“The Group’s effective tax rate for the current quarter and the year under review were lower than statutory tax rate mainly due to utilisation of previously unrecognised deferred tax assets.”

Mieco could continue to enjoy low tax rates for some time. According to a write-up by i Capital on Mieco, the company’s factory at Kechau Tui, Kuala Lipis has 100% Investment Tax Allowances which could be used to set off statutory income tax. Mieco’s 2014 annual report shows RM432.7m of unutilised investment tax allowance. i Capital also mentioned that Mieco's manufacturing subsidiary is tax-exempted for 10 years from 2005, with extension for another 5 years.

Ready capacity

After selling the land and buildings where its Semambu plant was located in 2014, Mieco is now relocating the Semambu plant to its Gebeng plant. Mieco's rationale for the disposal:

“The disposal was initiated and undertaken with a view of optimising operational efficiency and integrating the Semambu and Gebeng plant operations for longer term cost savings; a key part of our efforts to improve cost efficiencies and strengthen our bottom line. Whilst this was not an easy decision to make, we are confident that we have made the right one, and that the disposal of this asset will benefit MIECO over the longer term.”

The combined capacity of the Semambu and Gebeng plants is 300,000 cubic meters per annum.

Mieco in its 2Q15 financial notes said that the ground work for the Semambu plant's relocation had already started.

Mieco’s other plant is in Kechau Tui, Kuala Lipis. This RM400m “state-of-the-art technology” plant has one of the single largest particleboard production lines in Asia-Pacific with a capacity of 640,000 cu m per annum.

By comparison, Hevea’s particleboard manufacturing lines have an annual capacity of 525,000 cu m (but a CIMB report said only the 2nd line with a capacity of 405,000 cu m is used to manufacture particleboards, while the 1st line with a capacity of 120,000 cu m is used to produce packaging material). Revenue from Hevea’s particleboard segment was about RM181m in FY14.

Mieco’s Kechau Tui plant isn’t running at full capacity. This means it has ready capacity to pick up any rise in demand. New capacity will also be ready once the relocation of the Semambu plant to Gebeng is done.

*********

“…we continue to expect local particleboard demand to be driven by stronger furniture exports. This, coupled with the expected increase in production output arising from plant efficiency, is expected to spur the growth of Group revenue in 2015.”

– Mieco Annual Report 2014